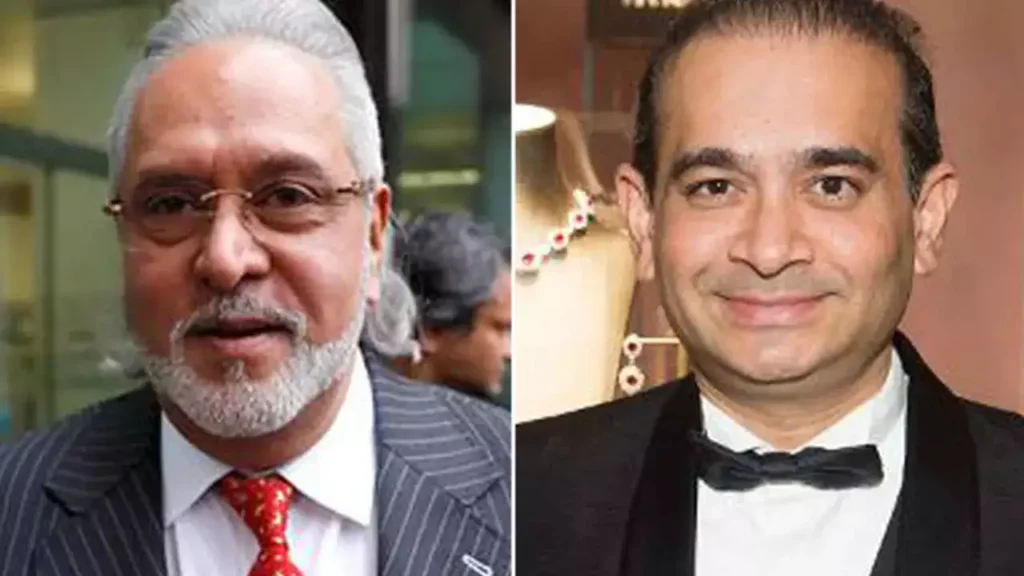

India has been fighting the war against economic fraud, and the cases of Indian fugitives who hold large amounts of money highlight this. Such high-profile individuals as Nirav Modi and Vijay Mallya are only the tips of the iceberg in a list of people who have absconded from paying their large debts in India. The aggregate amount for 31 such individuals has soared to Rs. 40,000 crore. Let’s explore what this means for the Indian economy, why these individuals are still absconding, and what India is doing to apprehend them.

What Led to the Rs. 40,000 Crore Debt?

About Rs.40,000 crore is owed by Indian fugitives, most of which are due to loan defaults and unpaid debts through fraudulent practices. Most of these individuals have exploited loopholes to drain cash from different spheres of the financial structure. High-profile cases, including Nirav Modi and Vijay Mallya, are famous for their liabilities running into several billions of rupees to Indian banks, mostly public-sector banks.

These financial wrongdoings generally involve:

- Bank Fraud: Many of these individuals are charged with banking fraud, mainly involving the embezzlement of funds obtained through loans from public sector banks or defaulting on the loans they had secured.

- Tax Evasion: Some of these fugitives have been accused of tax evasion on a large scale.

- Corporate Scams: Some fugitives left due to pressure from functions such as detecting fraud when officials started investigating their financial activities.

Who Are These Notable Fugitives?

Many of them, including Nirav Modi and Vijay Mallya, were well-known individuals with flamboyant lifestyles after fleeing India. Here’s a closer look at some of them:

- Nirav Modi: Diamond tycoon Nirav Modi allegedly embezzled over Rs. 11,000 crore from the Punjab National Bank through fraudulent transactions. He left India in 2018 and was eventually arrested in the United Kingdom. Now, the Indian government is trying to deport him back to India, though legal hurdles have delayed the process.

- Vijay Mallya: The former liquor baron and owner of the now-grounded Kingfisher Airlines has a liability of around Rs 9000 crore to Indian banks. Charged with financial fraud and money laundering, he escaped to the UK in 2016, with the Indian government seeking his extradition, legal cases in Britain delayed the process.

- Mehul Choksi: Mehul Choksi, Nirav Modi’s uncle, is a known mimic and another fugitive involved in the PNB scam. He fled to the Caribbean island nation of Antigua and Barbuda. Despite efforts to extradite him, his legal defense and nationality issues have complicated matters.

Other fugitives include Jatin Mehta, who was accused of defrauding various banks, and Sandesaras of Sterling Biotech, who have also left abroad to evade punishment.

What Is the Government Doing?

The following are some of the many difficulties when extradition of these fugitives and recovering their dues is sought:

- Legal Hurdles: Every country has its unique legal system. Fugitives take advantage of such variations, using asylum and appeals on humanitarian grounds.

- Lack of International Cooperation: India has extradition treaties with various countries worldwide; however, legal formalities and political barriers may delay the extradition process.

- Prolonged Legal Battles: Most of the time, the accused get high-profile legal teams to represent them. This results in lengthy court cases that postpone extradition.

- Economic Influence: Some of these escapees have substantial financial power and contacts, so they can readily seek safe harbor in other countries and evade extradition.

India presents a difficult challenge in dealing with financial fugitives who have cheated the country. However, enacting laws like the Fugitive Economic Offenders Act has improved the country and much more remains. International cooperation, better regulations, and easier extradition will bring these offenders to justice. Finally, India’s quest to claim back the Rs 40,000 crore due to fugitives is about economic justice, accountability, and the preservation of public trust.